Tax Breaks for College Expenses

August 23, 2018

New Per-Diem Rates Go into Effect

October 2, 2018 According to Adam Smith’s Canons of Taxation, the tax compliance function in any society needs to be convenient. This has not always been the case for many seniors in the United States. Form 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents, currently used by eligible taxpayers under age 65, is not available to older taxpayers. Seniors age 65 and older may also not find relief in filing Form 1040A, U.S. Individual Income Tax Return, because of its $100,000 cap on taxable income and its prohibition on itemized deductions.

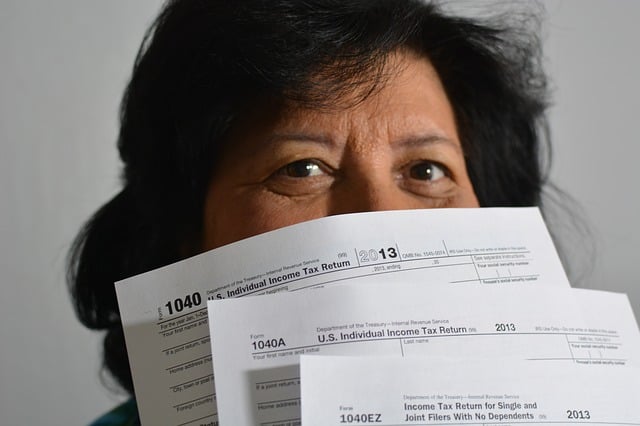

According to Adam Smith’s Canons of Taxation, the tax compliance function in any society needs to be convenient. This has not always been the case for many seniors in the United States. Form 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents, currently used by eligible taxpayers under age 65, is not available to older taxpayers. Seniors age 65 and older may also not find relief in filing Form 1040A, U.S. Individual Income Tax Return, because of its $100,000 cap on taxable income and its prohibition on itemized deductions. The Bipartisan Budget Act of 2018 (BBA), P.L. 115-123, passed on Feb. 9, 2018, attempts to alleviate this burden, beginning in 2019, for many senior citizens in the United States. The BBA requires the “Secretary of the Treasury, or the secretary’s delegate, to make available Form 1040SR,” which would be similar to Form 1040EZ except that anybody age 65 and older may use it. In fact, only taxpayers who are 65 and older may use it. During the 37-year history of Form 1040EZ, seniors have never been able to use that form.

The BBA, however, does not preclude older taxpayers from using Form 1040A or Form 1040 when filing their returns. It simply offers them another option, especially if they don’t use the services of a tax professional.